More Benefits Than Ever Before

Emergency Cash Facility and Concierge Services Withdrawn

We understand how important it is to feel financially secure while travelling.

Due to recent changes in geopolitical conditions, several countries have updated their policies and regulations around issuing foreign currency to Forex Cards issued outside their borders.

Because of these changes, HDFC Bank has withdrawn the Emergency Cash facility and Concierge Services on all Forex Cards with immediate effect.

This decision was made to comply with global regulations and ensure clarity for our customers.

We know this may be disappointing, especially if you rely on this service. We're here to help you stay prepared.

What You Can Do?

To ensure peace of mind while travelling:

Request a backup Forex Card when purchasing your primary card

The backup card can be activated instantly if your primary card is lost, damaged, or not working

Your Forex Card Will Continue to Work For:

International ATM withdrawals and balance enquiries

Online payments on international websites

In-store purchases at global merchants

Contactless (Tap & Pay) transactions

Need Assistance?

If you have any questions or need support, we're always here to help:

Within India: 1800 1600 / 1800 2600

From Overseas: +91 22 6160 6160

What’s In Store For You

Additional Benefits

Documents Required To Get You Started

Originals and self-attested copies of applicants and/or guardians:

Know more about the card

-

Card Management & Control

-

Application process

-

Fees & Charges

-

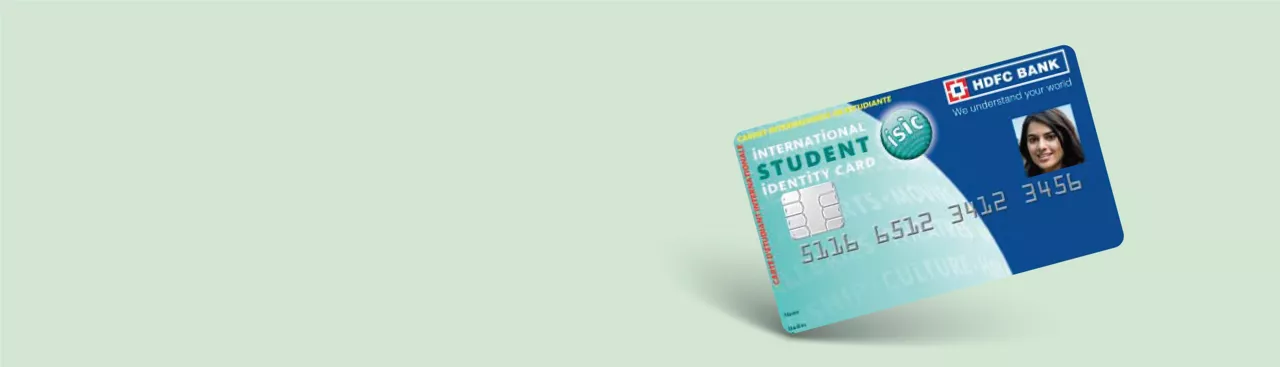

Dual Card - Forex Card and Identity Card

-

Card Loading & Validity

-

Secured Transactions with Chip & PIN

-

Online usage allowed

-

Multiple reloading Options

-

Contactless Payment

-

Application Process

-

Offer

-

Most Important Terms and Conditions

Frequently Asked Questions

ISIC ForexPlus Card is available over the counter at HDFC Bank branches. You simply need to walk into our branch with required documentation and walk out with ISIC ForexPlus Card. The card will get activated within 4 hours from realization of funds.

Also you can apply by visiting www.hdfcbank.com -> Apply Online section or www.hdfcbank.com/personal/products/cards/prepaid-cards -> ISIC Student ID ForexPlus Card -> Buy Forex Card

You can check the balance on ISIC ForexPlus Chip card with the help of NetBanking facility. You will need to use the card number as user ID & IPIN issued to you as part of the card kit to login to NetBanking facility. Alternately, you can also contact our PhoneBanking services to check the balance on your ISIC ForexPlus Card.

After returning from the overseas trip, you are required to surrender unspent foreign exchange held by you within 180 days of return. You can retain foreign exchange up to US$ 2,000 (or equivalent) for future use after returning back to India.

ISIC ForexPlus Card can also be loaded on your behalf by someone authorized by you. Authorised person has to visit HDFC Bank branch with the necessary documents and funds. We’ll take care of the rest.

You can reload your ISIC ForexPlus card multiple times in future till the card gets expired:

- You can authorise the Bank to debit your HDFC Bank account by giving an HDFC Bank cheque or make payment using a local cheque drawn on HDFC Bank and reload the card for desired value.

- Reload requests can be made by any authorized person on your behalf. The person authorised by you for the same will need to come to bank branch and will need to provide the necessary documents to the bank to carry out reload. On receipt of the application form and the funds, your card will get reloaded for the desired amount.

- HDFC Bank customers can also place a request to reload the card through HDFC Bank Prepaid NetBanking which happens instantly or through HDFC PhoneBanking or HDFC Bank NetBanking.

The ISIC Student ForexPlus Chip Card is a globally recognised multicurrency card that also functions as an internationally recognised student identity card, endorsed by UNESCO since 1968.

The card offers exclusive access to over 150,000 products, services, and experiences in more than 130 countries. It provides preferential and discounted offers on educational courses, software licences, transportation, entertainment, and more.

No, there is an issuance fee of ₹300 per card. Reloading the card incurs a fee of ₹75+GST. Reissuance or replacement of the card has a fee of ₹100+GST.

The ISIC Student ForexPlus card CAN be issued to the customers above the age of 12 Years.