-

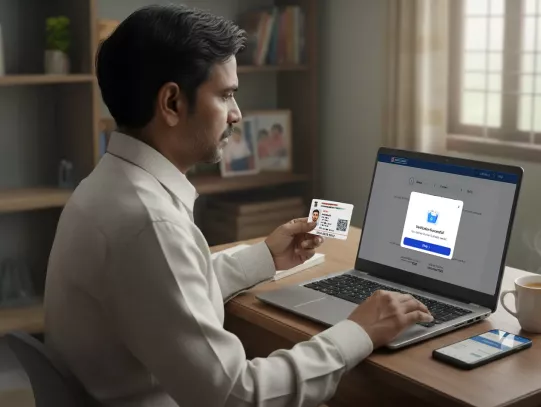

Via Website

-

How to Check Aadhaar Seeding Status?

What is Aadhaar Seeding and Why It Matters

Aadhaar seeding with Bank Account is linking or re-linking your Aadhaar number with your Bank Account in the bank’s records (and via NPCI where required). It allows you to receive government subsidies, Direct Benefit Transfers (DBT) and other Aadhaar-based services. For HDFC Bank, this is offered via its Insta Services platform.

Aadhaar bank seeding ensures that you get Direct Benefit Transfers (DBT) like LPG subsidies, pensions, scholarships, and welfare payments straight into your account.

It assists with Aadhaar-based authentication, KYC processes and facilitates transactions through Aadhaar Enabled Payment Systems (AePS).

By reducing friction in banking operations and streamlining e-KYC, it helps prevent rejections for services that require Aadhaar linkage.

It enhances security since having your Aadhaar-linked mobile number and identity aids in verification.

Frequently Asked Questions

Linking your Aadhaar number to your Bank Account means that your identity and account are tied together for Aadhaar-based verification and benefit transfer systems.

Aadhaar seeding is required for Direct Benefit Transfers (DBT). This process allows the government to send subsidies and benefits, such as pensions and gas subsidies, straight to your bank account. It also plays a crucial role in preventing fraud, cleaning up bank databases by removing duplicates, boosting security with Aadhaar-based authentication and encouraging financial inclusion.

You can easily check your Aadhaar seeding status online by visiting the UIDAI portal. Just head over to the Aadhaar Services page, enter your Aadhaar number, and verify it with the OTP that gets sent to your registered mobile number. Once you do that, the portal will let you know if your Aadhaar is successfully linked to your HDFC Bank account.

HDFC Bank customers can easily link their Aadhaar using Insta Services. Visit the Insta Services webpage, select the Aadhaar seeding option, fill in the necessary details and submit your request online. This way, you can securely connect your Aadhaar without having to step into a branch.

You do not need to link your Aadhaar to every bank account or financial product, like Fixed Deposits (FDs). However, if you want to receive any government benefits or subsidies, it is essential to do Aadhaar card seeding.

Aadhaar Seeding