What’s in store for you

More About Money Transfers

Click here to get the charges applicable on outward remittances

Transferring money to India offers several benefits:

1. Easy and instant money transfers from anywhere in the world.

2. Provides financial support to family and friends for daily needs or emergencies.

3. Competitive foreign currency exchange rates to ensure more value for your money.

4. Low and transparent fees.

5. Secured transactions

Transfers are usually prompt. For example, with HDFC Bank Wire Transfer, money passes through three intermediary banks before reaching the recipient's bank within a few days. Consequently, international wire transfers may require up to five business days.

Frequently Asked Questions

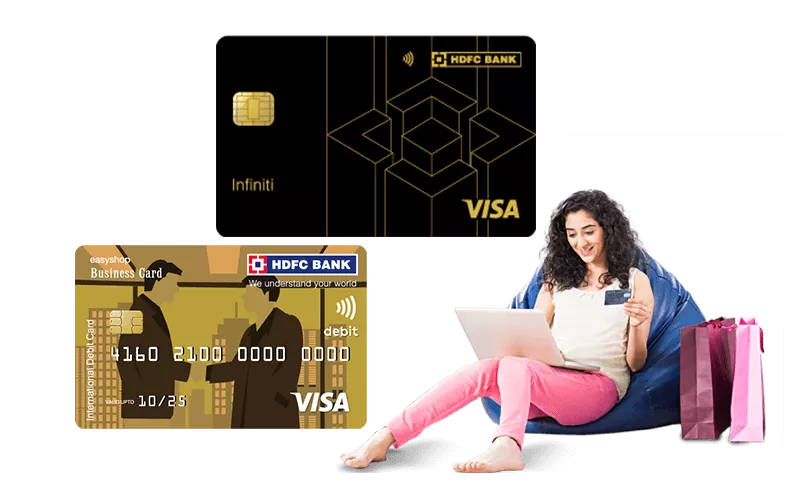

HDFC Bank offers several ways of money transfer to India from abroad. These are:

SWIFT/Telegraphic Transfers

IndiaLink

Demand drafts/cheques

Yes, you need a SWIFT code for NRI money transfer to India if you are using international bank transfers. The SWIFT code identifies the recipient's bank account, ensuring your money reaches the correct institution. You will need the recipient's bank account number and other relevant details, along with the SWIFT code.