-

Process

-

Important Information

-

Features of Insta Services

Who Can Use InstaServices?

Why Quick Access to Loan Documents Is Necessary

- Always Ready When You Need Them

- From tax filing to travel or future loan applications, your loan documents are just a tap away.

- Clear View of Your Loan Journey

- Check your repayment history, outstanding balance or closure proof without visiting a branch.

- Helps You Take Faster Decisions

- Whether planning a new purchase or applying for another loan, having documents on hand makes the process smoother.

- Convenient & Secure

- No need to dig through files or wait for couriers, your documents stay safe and accessible.

Frequently Asked Questions

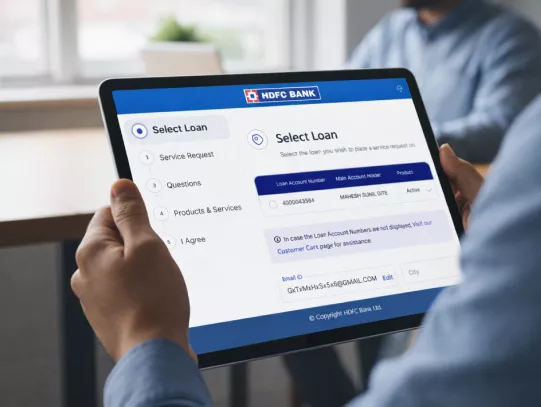

InstaServices is HDFC Bank’s digital platform where you can instantly access loan-related documents and services like repayment schedules, interest certificates, balance details, prepayment and more without visiting a branch.

You can manage ongoing and closed Personal Loans, Car Loans, Two-Wheeler Loans, Consumer Durable Loans, Gold Loans and other HDFC Bank Loans through the platform.

You can place a prepayment or foreclosure request instantly and make the payment online. Applicable charges, if any, will be shown before you confirm.

Most non-transactional requests like repayment schedules, interest certificates, or balance confirmations are free of charge. Transactional requests, such as prepayment or foreclosure, may involve prepayment and foreclosure charges.

Quick Access to Loan Documents and Requests Now!