-

Via InstaServices

-

Important Notes for InstaServices

-

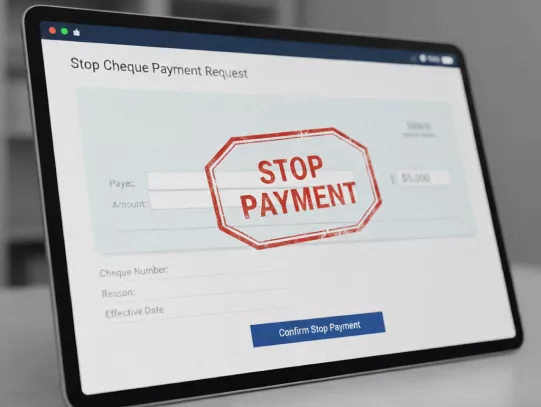

Via Internet Banking Portal

-

Over Phone Banking

-

Via Branch Visit

Pre-requisites for Stop Payment of Cheque(s)

Why You Might Need to Stop a Cheque Payment?

- You may wish to block or stop cheque payments when:

- The cheque was lost or stolen.

- You suspect fraud or unauthorised use.

- You entered an incorrect amount or payee name.

- A duplicate cheque has been issued.

- The cheque is unsigned or bears the wrong date/post-dated incorrectly.

Frequently Asked Questions

If the cheque has not yet been cleared or honoured, you may request cancellation of the stop-payment through the same channel, provided the cheque hasn't been processed.

For a particular cheque, it is ₹90, and for a range of cheques, it is ₹180. If done through NetBanking, there are no charges involved.

The funds stay in your Account (i.e., the cheque is not debited) unless someone else presents a valid cheque.

There isn't a fixed time limit imposed by the bank publicly, but the stop must be placed before the cheque is presented for clearance. Once cleared, it cannot be stopped.

You can check via NetBanking under request status or cheque/stop-payment history. Alternatively, branch or PhoneBanking can give you an update using your reference number.

Stop a Cheque Payment in HDFC Bank Now!