-

InstaServices

-

NetBanking

-

HDFC Bank Branch

-

Required Documents

-

Important Things to Remember

Pre-requisites for eNACH Registration

Overview of eNACH Registration

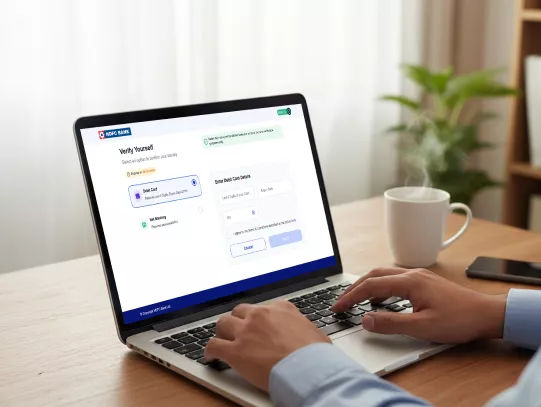

eNACH registration is a digital process that lets you authorise HDFC Bank to debit recurring bill payments directly from your Bank Account.

eNACH registration differs from traditional standing instructions because it is entirely online, faster, and managed under the NPCI eMandate framework.

It aligns with RBI guidelines, providing more transparency, pre-debit notifications, and easy cancellation.

With eNACH mandate registration, your payments are automated, reducing the risk of missed due dates.

You authorise HDFC Bank to debit a fixed or variable amount towards a registered merchant or service provider.

Your Account details, mobile number, and Debit Card credentials are used for secure authentication.

As per RBI rules, you receive an SMS notification before every debit. This SMS includes a link to view, modify, or cancel the upcoming payment.

This system offers better control and higher transparency compared to older methods.

HDFC Bank's smart standing instruction system is designed with your security in mind:

Fully compliant with PCI-DSS, NPCI, and RBI guidelines.

SMS alerts before every debit give you greater control.

Instant set-up and cancellation options through NetBanking or a branch.

No need to remember due dates; your bills are managed automatically.

Frequently Asked Questions

Aadhaar can be used for authentication, but PAN or other valid ID proof may also be accepted as per current KYC norms.

The process is secured by multi-factor authentication, RBI guidelines, and PCI-DSS compliance. SMS notifications before each debit give you extra control.

You can log in to NetBanking or visit a branch to modify or cancel your standing instructions. Changes take effect as per the next billing cycle.

Typically, auto-debits start within a few working days after successful eNACH mandate registration. Timelines may vary by merchant.

Currently, HDFC Bank does not levy charges for eNACH registration or cancellation. Merchant-specific fees, if any, may apply.

Set Up Smart Standing Instructions with HDFC Bank Now!