-

InstaServices

-

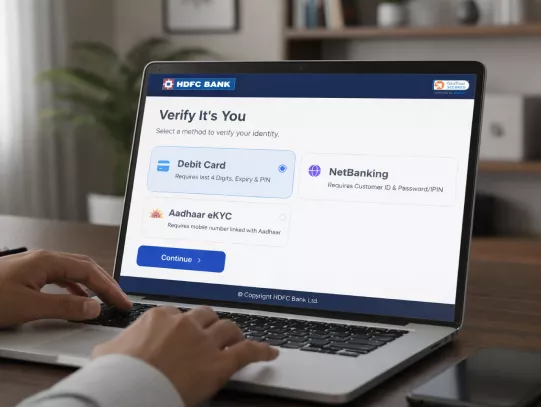

NetBanking

-

Branch Visit

-

Important Things to Remember

Overview of FD/RD Liquidation

Fixed Deposit Withdrawal: An FD withdrawal refers to encashing your Fixed Deposit after it matures or before maturity.

Recurring Deposit Withdrawal: An RD withdrawal refers to the process of stopping your Recurring Deposit and withdrawing funds accumulated so far.

You can choose:

Maturity Withdrawal: Close the FD/RD after its full term.

FD Premature Withdrawal/FD Before Maturity: Withdraw funds before the maturity date.

Emergency Funds: Quick access to savings during urgent situations.

Reinvestment Opportunities: Move funds to better-performing investments or Accounts.

Convenience: Online FD withdrawal ensures instant credit to your linked Savings Account.

Frequently Asked Questions

HDFC Bank does not currently offer partial FD withdrawal. You would need to break the full Deposit or open multiple FDs for flexible access.

FD premature withdrawal may attract penalties or reduced interest rates, depending on how early the closure happens.

Funds from online FD liquidation are generally credited instantly to your linked Savings Account. For branch requests, credit may take up a few working days post-verification.

Yes, as long as it meets eligibility (sole ownership and NetBanking active), you can use Insta Services or NetBanking.

TDS will be deducted on interest earned as per the income tax rules.

Liquidate Your HDFC Bank Fixed Deposit Now!