-

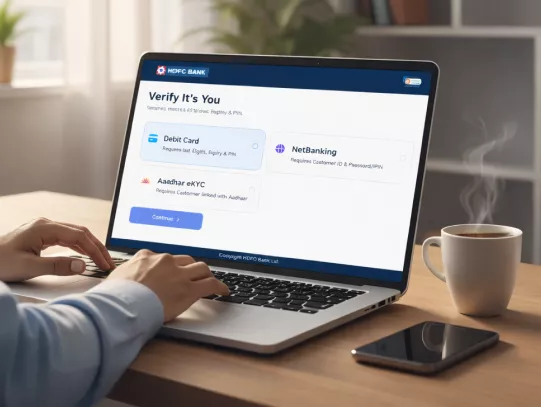

Via Xpress Forms

-

Via NetBanking

-

Key Considerations

Overview of Interest Certificates

An interest certificate is a formal document provided by your bank that outlines the total interest you've earned on your deposits. Whether they’re savings, fixed, or recurring. You can also get the Loan interest certificate for the interest you have paid on loans during a specific financial year. It includes important details such as your account number, the interest amount, the period covered and your name.

When you're filing your Income Tax Return (ITR), you will need this to back up any claims for interest income or deductions on loan interest. It is essential for verifying interest amounts, whether for financial audits or just keeping your personal records in check.

This document promotes transparency by showing exactly what interest has been credited or charged throughout the year. It is also handy when you're applying for Loans, visas or any other official paperwork that requires proof of income or expenses.

Frequently Asked Questions

An interest certificate is valid for the financial year it is issued for. If you are planning to use it for tax filing, just make sure it matches the interest dates for that year.

You can download the interest certificate for deposits anytime. For interest earned on deposits, you can download it for either the current or previous financial year, as long as the interest data is updated. However, if you are looking for Loan interest certificates or interest paid, you might have to wait until after the year ends.

If you have interest income or Loan interest expenses, having that certificate can back up your claims.

Head to your branch or get in touch with customer support right away. Make sure to provide the correct details like your account number, name and PAN, and ask for a revised certificate.

If the account is joint, any of the account holders can request the certificate. However, they must have the necessary permissions.

Interest Certificate